Insights of a foreigner opening a US company through Stripe Atlas. My experience on filing tax returns, opening bank accounts and much more.

Here’s a quick overview what we’ll cover in this blog post:

- Initial Process

- Cost

- Required documents

- Timeframe

- Waiting for EIN

- Reply time by Stripe support

- Difference for foreign nationals vs. US residents/nationals

- Do I need a PO Box or an office?

- How do I get a US phone number?

- Opening bank accounts

- Bookkeeping

- What’s needed?

- Tax Returns

- Federal Corporate Tax

- State Tax: Don’t have to file for state tax if I’m not a resident

- Sales Tax: Where and how much sales tax should I collect?

- Delaware Franchise Tax

Intro

It’s been almost a year since I incorporated our SaaS startup in the US using Stripe Atlas. As a non-US resident and German national it’s been really interesting going through the process of opening a business in the US. I wanted to share some of my learnings and hope others find value in them. I wish I would have known a lot of those things before starting the process. It would have saved me hours and hours of research and that’s why I decided to start this series of blog posts. Throughout the next couple of weeks I’ll be publishing a bunch of articles that cover a lot of very specific topics around running a SaaS business in the US from abroad as a foreign national. I hope this helps other founders and entrepreneurs on their journey.

Before we get started, a quick disclosure: I’m not a professional tax advisor, accountant or immigration lawyer. Hence my experiences should be taken with a grain of salt. I don’t take any responsibility for the correctness of the information provided. Please always seek professional legal advice when it comes to subjects like taxation, immigration or legal matters.

Questions I had when opening a US business

Throughout this blog post I will shed some light on how the process of setting up a company using Stripe Atlas worked. There is a decent amount of information available online about how the process of opening the company through Stripe Atlas works. But any information about running the business, filing taxes and so on is sparse. Topics like taxation, bookkeeping, opening bank accounts and hiring are not covered anywhere. I remember when I started I had a bunch of unanswered questions that Stripe Atlas didn’t help to clarify at all:

Here are some of the things I didn’t know at all:

- Is Stripe Atlas the best option?

- Is a C-Corp the best option?

- Do I need an office or is a PO box (postbox) enough?

- How do I do my taxes after opening a company in the US through Stripe Atlas

- Where and how do I file state tax if I’m a non-resident?

- What requirements are there in terms of bookkeeping?

- Do I have to pay Sales Tax?

- Is Delaware the best option as a bootstrapped Startup?

The list was probably longer than that. Throughout this blog post I’ll cover those questions. Additionally I will work on more specific blog posts tailored to taxation and other things in the next coming weeks, so stay tuned for that.

Is Stripe Atlas the way to go?

Let’s discuss this real quick. It’s one of those questions that I remember from the early days when I started looking into opening a business in the US. Even now after roughly a year has passed, I’m not sure Stripe Atlas is the best option. But as often in life it’s more important to make a decision and move on rather than optimizing everything and then not executing at all. My overall experience was okay and we didn’t really have any major hiccups.

Stripe Atlas isn’t the only option to open a business in the US from abroad. While doing my research I also evaluated opening the company with the help of a business attorney. The major difference here is that Stripe Atlas only allows you to incorporate in Delaware. While Delaware is a very business friendly state, it’s by far not the only state that you should consider. The annual franchise tax and filing fee in Delaware is roughly $500 whereas in Wyoming for example it’s under $100. There’s no state corporate tax in either state.

For me personally it didn’t really matter in which state the business was incorporated. If you’re trying to raise money further down the road I would highly recommend Delaware since most VCs prefer dealing with Delaware corporations. If you’re a bootstrapped, self-funded startup and you want to save a few hundred bucks per year then you can look into Wyoming or other states.

Another benefit of Stripe Atlas is that they’ve partnered with banks to make it seamless for you to open a bank account and Stripe account from abroad. Prior to the SVB collapse, Silicon Valley Bank was their preferred partner, this seems to have changed now and you can now open an account directly through Mercury or Novo (see: https://stripe.com/docs/atlas/payments-business-bank).

Even if you decide to not open your company with Stripe Atlas, opening a bank account with an online bank from abroad is super easy once you have your EIN number (Employer Identification Number – sort of the SSN of a business). Mercury bank for example even sends you a physical card to any location in the world.

A quick note on Federal and State tax. If you open a US company you will always have to pay federal corporate tax and in some states on top of that state corporate tax. There’s this massive misconception that Delaware is a tax haven with 0% tax, which is simply not true. As a Delaware business you still pay 21% federal corporate tax.

The initial process: Opening the company through Stripe Atlas

Application & Fees

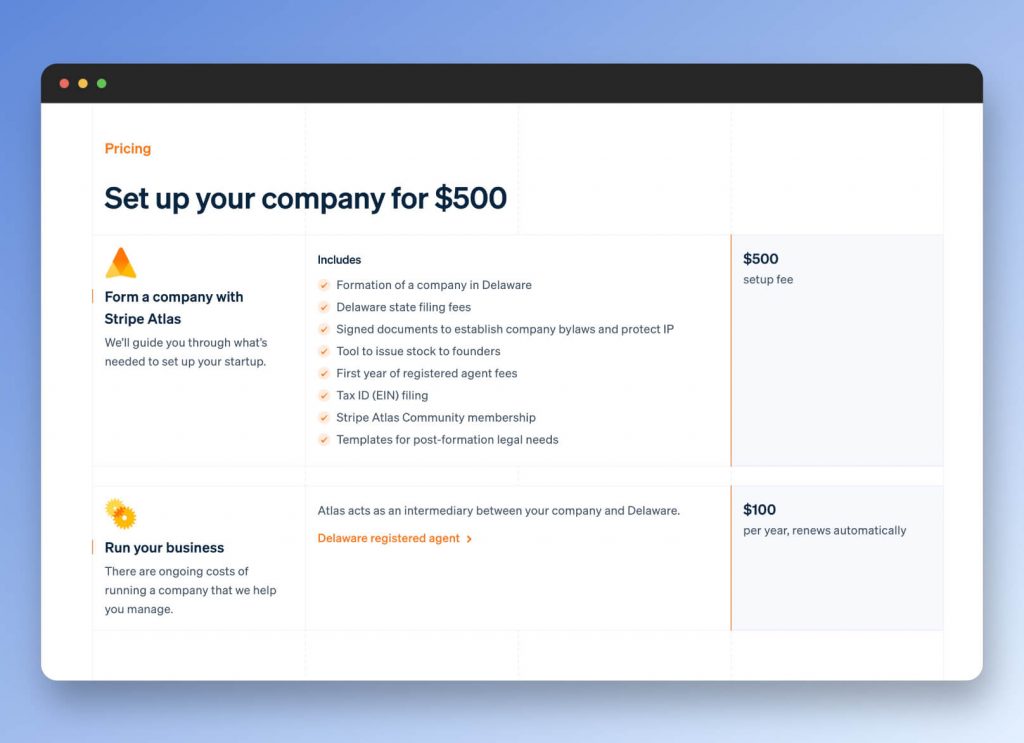

The initial process of opening the company is fairly straightforward. You simply sign up for Stripe Atlas and file your application. The entire process costs $500 plus $100 for the first year registered agent fees. In the very first step you can decide if you want to incorporate as a C-Corp or an LLC S-Corp.

What’s the difference between a C-Corp and an LLC S-Corp you ask? The most significant difference is that a C-Corp pays corporate tax whereas the an S-Corp (mainly LLCs) does not pay corporate tax. Instead all profits are being passed onto the company owners. This means the company owners need to pay tax on the company profits with their personal income tax. This can get fairly complicated if you are a non-US resident and pay tax elsewhere.

I’ve been advised go with C-Corp since the international tax implications are difficult to sort out.

Required Documents

In order to complete the Stripe Atlas application you need the following documents:

- Passport

- A valid address abroad

- A valid business address (P.O. box is ok)

- A US phone number

- Your local Tax ID issued by your home country (required)

- Ownership structure (if you’re a solo founder this is easy)

I’ll only go into the details of some of those things, since the rest should be covered by the Stripe Atlas documentation.

Physical Address in the US

Most of those things should be very straightforward to get, but I wanted to go into more details about the business address in the US. When I initially set up the company I was also very confused if I could use a P.O. box as the business address. It worked in our case and we currently only have a P.O. box in the US. Some services will specifically mention that you can’t use a P.O. box as the address, but in my experience it worked regardless.

Stripe Atlas recommends you to use Earth Class Mail. That’s what we went with but the service is by far not cheap. At $44/m I think this is quite an expensive service that we really never use. Each document that gets scanned will be charged at an extra fee, so you need to make sure to receive as little mail as possible. I would highly recommend doing some research here and potentially opt for a cheaper provider.

Important side note: Try to get a P.O. box in Delaware and not in another state. I initially didn’t pay much attention to it and got a P.O. box in Texas. If you later sign up for any online service (this includes Cloud Services like AWS, …) with your address in Texas for example, you’ll be charged Sales Tax on top of your invoice amount. Any service you sign up for will charge you sales tax depending on the address you put down. Since Delaware has 0% sales tax this is a major reason to pick a P.O. box in Delaware. The sales tax can be as much as 9% depending on the state you pick. If you rack up a bill on AWS or something else that can be quite a significant amount.

A valid address abroad

You need to put down a physical address abroad where you are registered. In my experience this address isn’t too important since you won’t receive any physical mail there. All documents about the business will be either sent to your virtual P.O. box or are available in your Stripe Atlas dashboard later on.

A US phone number

In order to sign up you also need a US phone number. I got quite lucky here since I still had a valid US phone number through Google Voice from a previous trip to the US. If you don’t have one at all you can always sign up for a service like FreshCaller or OpenPhone. The prices range from $5-$20/m.

How long does it take to incorporate?

The process took about a month from filing the initial application to receiving our EIN. This was longer than expected, but seems to be normal for non-US residents. According to the Stripe Support Team the IRS also had a massive backlog which was causing delays on their side. I believe this process would have taken the same time regardless if we would have incorporated it without Stripe Atlas.

During the process I’ve emailed the Stripe Support team a bunch of times to check if there is any progress. Stripe was fairly quick in getting back to me and always kept me posted.

I initially filed our incorporation on May 20th 2022. On June 23rd 2022 we received our EIN.

So how many does it take to receive your EIN when incorporating through Stripe Atlas: 35 days in your case.

You will receive an email from Stripe Atlas telling you that your EIN is available.

The email looks like the following:

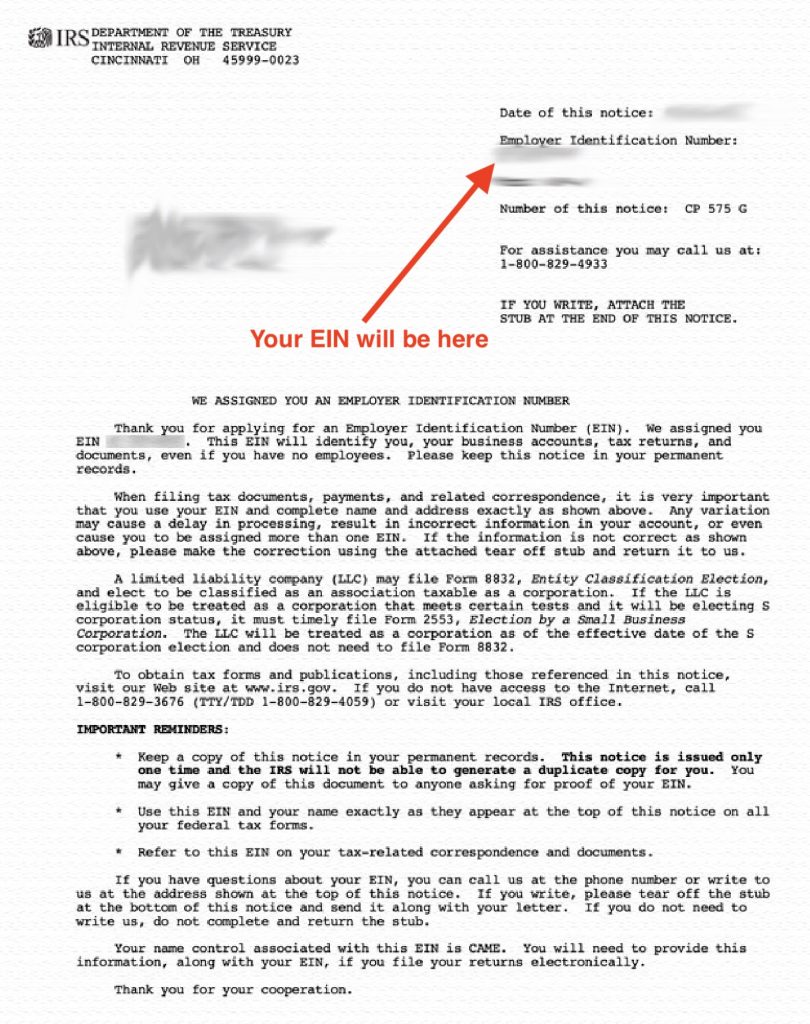

After your EIN was issued you’ll find the official document from the IRS including your EIN as well as other documents like your Certificate of Incorporation, By Laws and Board Approval Letter and so on.

Quick note for all US residents and nationals: The processing time for the EIN number might be significantly lower if you’re a US national or resident.

Opening bank accounts

Once we had our company incorporated and the Stripe account setup the next challenge was to get a bank account up and running. I personally decided against opening a bank account through Stripe Atlas. Fortunately I had a trip to the US coming up so I decided to rock up to one of the major banks and set up an account myself. In retrospect that was a brilliant idea since I would have ended up with an SVB account otherwise.

Opening an account with Bank of America, Chase or similar

Opening a bank account with one of the major banks in the US as a foreigner isn’t easy. They certainly don’t allow you to do so from abroad. If you happen to be in the US and have your EIN number and a valid passport then each of the major banks should be able to open an account for you. Opening a personal account as a non-resident is far more difficult, but that’s a story for another article.

Most US banks offer some sort of a free business checking account if you maintain a minimum balance. In the example of Bank of America that balance is $15.000. Chase and Wells Fargo have similar offerings.

When opening a business bank account you can use your P.O. box as the registered address with your bank and let them mail your physical card to a separate location. If you’re unable to receive your business card at an address in the US, give them the P.O. box address. In addition to your physical card, Bank of America also allows you to set up a virtual card that can be used with Apple Pay or Google Pay straight away. You can get the virtual card setup straight from the Bank of America app.

All we’ve been talking about so far was how to open an account and get a debit card. What about a business credit card you ask? Well… I’ve been advised to wait with an application for a credit card for a few months in order to increase the chances of approval. So stay tuned for an update here …

Especially in the midst of the latest banking crisis I personally found it very helpful to have a business checking account with one of the major banks in the US. I personally went with Bank of America but the differences between the offerings are minor in my opinion.

Opening an account with an online bank

A lot of online banks will allow you to open an account without being physically present in the US. This can be really helpful in some scenarios.

Here’s a few of the most popular online banks in the US:

- Mercury

- SVB

- Wise.com

- Novo

I personally decided to open an account with Wise.com. Especially to send money abroad, this is really helpful. We pay freelancers in different countries and currencies across the globe and Wise has one of the lowest fees in the market. In order to open an account with them you need your EIN and your P.O. box address.

If you’re from Europe then you might also think about Revolut. They started offering business accounts for US companies, but unfortunately they did not approve our application. The reason they gave us was that you currently can only open a bank account with them as a US resident/national.

Bookkeeping

Bookkeeping is a complicated topic and it will highly depend on your business what to do here. If you have investors, you’re planning to raise money or an annual turnover of something north of $1-2m then it might make sense for you to hire a dedicated bookkeeper. Bookkeeping is a separate matter to your annual tax obligations and filings. That being said, your tax filings will be based on your books and you need to have your numbers ready in order to hand them over to an accountant. There certainly are accountants that also do bookkeeping. A good alternative that I’ve been recommended is Bench.co. Bookkeeping services like Bench will sort your bookkeeping for you for a monthly flat fee (starting at $299/m). I personally don’t have any experience with Bench.co but various people have recommended the service to me.

Bookkeeping Software

If your numbers are fairly simple then you might be able to do the bookkeeping yourself by using a service like QuickBooks. Even if you decide to collaborate with a bookkeeper then they might advise you to set up a QuickBooks account. QuickBooks allows you to automatically import all numbers from your bank accounts, PayPal account and even Stripe. If you pay all your business expenses directly with your business card then even outgoing transactions will show up in QuickBooks and your accountant should be able to base his numbers on that.

Generally speaking you do not have any legal obligation to do monthly bookkeeping. That means if you decide to do your book only once a year prior to tax season (usually that is in April each year) that is also fine.

Tax Returns

This is a big big topic. At this point in time I want to mention again that I’m not a professional tax advisor, accountant or lawyer. I don’t take any responsibility for the correctness of the information provided. All information provided here is based on my experience and all actions you take should be consulted with a certified professional.

Tax returns are scary. Especially if you’re new to a country and have never done them before. My advice here is: Don’t be too worried. The process is fairly straightforward and I can tell you that it’s definitely doable. Reading up on it online will certainly help, but even then you might get a very overwhelming impression. I can tell you that compared to filing taxes in Germany the process in the US is a breeze.

Let’s break the process down into a few different pieces. I’ll be covering this part with a C-Corporation in mind (Inc.). Your tax obligations might be slightly different if you’ve opened an S-Corp (LLC).

Your tax obligations as a foreign individual are as follows:

- Federal Corporate Tax

- State Corporate Tax

- Sales Tax

Federal Corporate Tax

Each corporation (and thus also your startup) has to file Federal Corporate Tax returns every single year. The Corporate Tax in the US is currently 21%. Corporation tax is only paid on profits and not on revenue. In your corporate tax returns you have to declare how much revenue and expenses you had in the last year. Additionally you can write off certain things like purchases of hardware or other inventory. There are various forms that you need to file each year in April. I would highly advise you not to do your tax returns yourself. We’ve worked together with a CPA to file our taxes and especially if its your first tax return I would not advise you to file it yourself.

Here are the forms for the corporate federal tax return that we’ve filed:

- 8879-CORP

- 1120

- 5472

- 4562

If you work together with an account then they will prepare those documents for you and send it back to your for review.

Deadline in 2023 for the corporate tax returns was April 18, 2023. Make sure to file before the deadline to avoid penalties.

State Corporate Tax

This was more interesting to figure out. Usually corporations have to file and pay state tax on top of federal tax. In which state you have to pay state tax is depending on where your corporation has Nexus. This was a new learning for me. The definition of Nexus isn’t as straightforward, but a good rule of thumb is: A company usually has Nexus in a state if it has any kind of facility (office) or employees.

This in turn also means: If you do NOT have any employees or an office in any state and your company is completely managed from abroad you do NOT have to file any state tax returns.

I was very surprised by this, but it certainly makes your life easier. Additionally I would still advise you to incorporate in a state with 0% corporate tax (e.g. Delaware, Wyoming, Florida, Texas are just a few that don’t levy any corporate income tax on top of the federal tax).

Sales Tax

Sales tax is another delicate subject. If you’ve been to the US before you may have noticed that sales tax is charged on top of each purchase and varies by state. Now obviously a few questions arise:

Do I have to pay sales tax for my SaaS sales with a US company?

How much sales tax do I have to charge for my SaaS sales?

Is sales tax based on the customers location or my SaaS business location?

The answers are not as straightforward. A few factors play into it. Each state has a different sales tax rate and usually the sales tax rate is calculated based on where your customer is located (not your company). Not all states require you to pay sales tax on digital goods. Additionally most states have a threshold of $100.000 or 200 transactions per year. That means if you have less than $100.000 in revenue in a state chances are you do not have to collect sales tax.

A very good article about this topic can be found here: https://stripe.com/guides/introduction-to-us-sales-tax-and-economic-nexus

Here’s a nifty tip: Stripe monitors your sales within the US and notifies you once you’ve crossed certain thresholds. The only thing you have to do is opt into Stripe Tax within the Stripe dashboard.

Delaware Franchise Tax

The Delaware Franchise Tax obviously only affects companies that were incorporated in Delaware. If you have incorporated in Texas, Wyoming or a different state then this process will look different. Since Stripe Atlas currently only allows you to open in Delaware, we will only cover this part here.

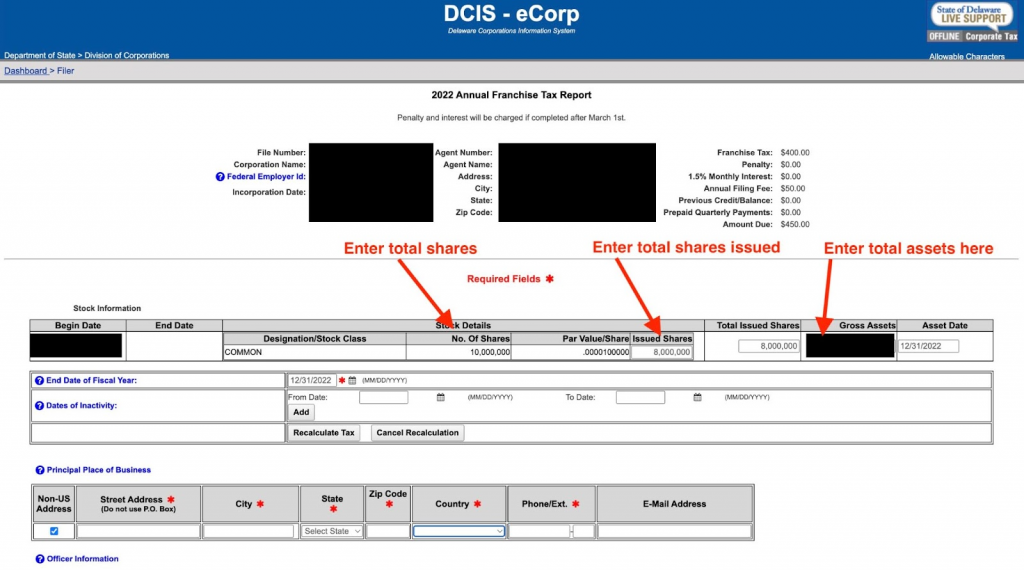

The Delaware Franchise Tax is due every year and must be filed before March 1st. Make sure to not miss any deadline, otherwise hefty penalties might be waiting for you.

For most companies the franchise tax for Delaware will be $400 + $50 filing fee.

Your accountant should be able to file the Delaware franchise tax for you. That being said it’s also not very difficult to file the Franchise Tax returns yourself.

The form to file is available here: https://icis.corp.delaware.gov/

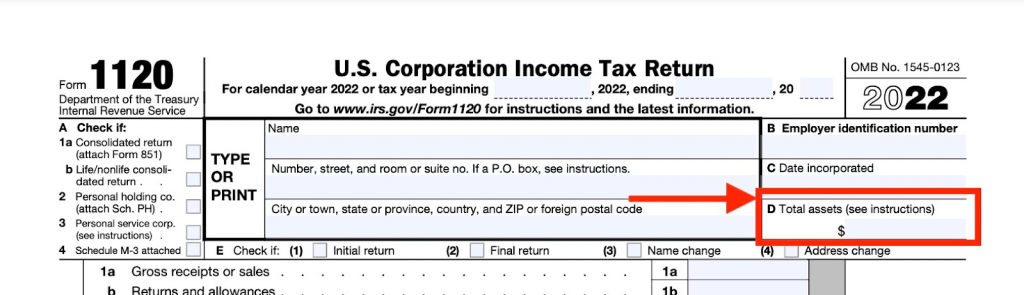

In order to file the Delaware Franchise Tax you need to have your Federal Tax returns and your EIN ready. The reason you need your Federal Corporate Tax returns is that you have to declare the total assets of your company. This number will also be filled into field D in your Form 1120 of your U.S. corporation income tax return. Additionally you need to declare the total number of shares issued and the total number of shares. You can find those numbers in the documents in your Stripe dashboard.

As I’ve already mentioned I would still recommend you to file the Delaware franchise tax through your accountant or CPA. Especially in the first year you definitely don’t want any mistakes to slip in and pay penalties.

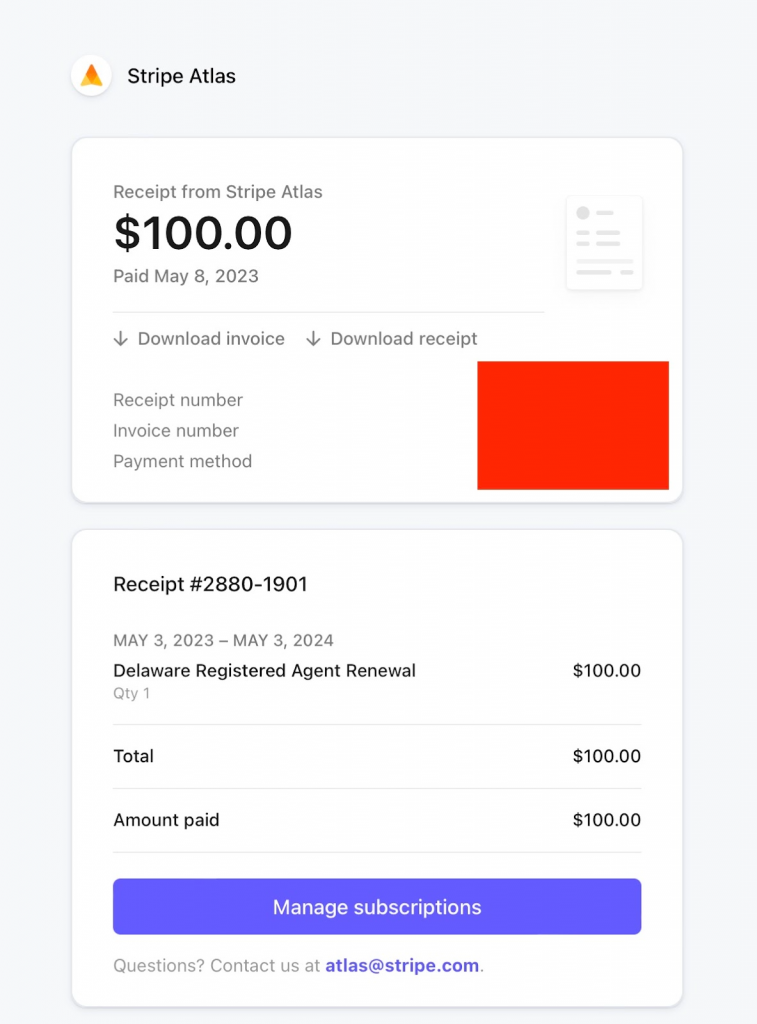

Registered Agent

When you initially sign up for Stripe Atlas your company gets registered with a Registered Agent.

In the U.S., a registered agent is a person or company chosen by a business to receive official papers and legal documents on their behalf and is a requirement. Each year you have to pay a $100 renewal fee for your registered agent. Stripe will automatically charge your credit card that you used when initially signing up for Stripe Atlas to charge that renewal fee.

Let’s wrap this up

Opening and running a business in the US as a foreigner can be a scary endeavor. I hope my learnings and experiences in this article will help some of you to be more aware of what awaits them while opening their company in the US. Stripe Atlas certainly can make it seem like it’s as easy as filling out a few forms, but their guidance and support suddenly ends when the initial corporation is done. If you keep a few things in mind and file all tax returns by their deadlines, it’s really not that complicated to run a company in the U.S.

Before wrapping this article up I wanted to give you a quick overview about the recurring cost that you’ll have:

Your annual expenses to run a US company

Delaware Franchise Tax: $450

Stripe Atlas Registered Agent: $100

P.O. Box: $44/m = $528

US Phone number: $5/m = $60

Accountant/Bookkeeping: $1000-2500

TOTAL: roughly $3638 per year

Questions? Let me know!

I hope this article has been helpful. If you have any questions, feel free to leave some comments in the section below. I’ll try to help as much as I can.

Until next time 🚀

Awesome! Thanks!

Thank you for the guide. But on a side note, how is taxation handled ? Are you paying 21% tax on the revenue generated from your company ? Are the funds collected in your Mercury bank account ?

Great article and very helpful.

Great article and thanks alot. What if i have a brother in the US. Can I use his address?

Excellent article! Really helpful. Danke!

Thank you so much! Especially for the rundown on total cost per year in the end! Very helpful to hear from an unbiased source!

Thank you so much for taking the time to do this!